- No income tax for people earning less than Rs 3 lakh

- Sitharaman proposed the extension of concessional duty on lithium-ion cells

The recently announced budget by Finance Minister Nirmala Sitharaman brought some relief to the income-tax payers. This included a revision of the income tax structure and the rates for different classes. Under the new income tax regime, the tax rate on income under Rs 3 lakh will be nil. Check out the new tax structure below:

Rs 0 - Rs 3 lakh: Nil

Rs 3 lakh - Rs 5 lakh: 5 per cent

Rs 6 lakh - Rs 9 lakh: 10 per cent

Rs 12 lakh - Rs 15 lakh: 20 per cent

Rs 15 lakh and above: 30 per cent

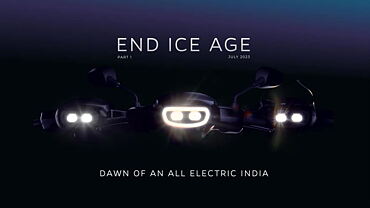

The revised income tax rates will result in a higher disposable income and it should boost two-wheeler sales in the Indian market in the coming months. Further, the government has also announced initiatives to boost the sales of electric vehicles. Sitharaman proposed the extension of concessional duty on lithium-ion cells used for batteries for another year.

Speaking about the announcements, Banwari Lal Sharma, CEO, Consumer Business, CarTrade Tech, said that the Union Budget 2023-24 announced by Finance Minister Nirmala Sitharaman is progressive, prudent and growth-led, with an eye to providing impetus on the savings of the public. Sharma further added that the sustainability measures taken through announcements on green hydrogen and other energy sectors will help in furthering the government’s target of carbon neutrality by 2070.

Commenting on the Budget 2023, Dr. Pawan Munjal, Chairman & CEO, Hero MotoCorp, said that the budget does a very good job of balancing fiscal prudence with inclusive growth. Dr Munjal further added that the budget proposals, particularly around capital expenditure, agri-credit, infra-development credit, and lower tax slabs, will result in higher disposable income in the hands of consumers and help the growth of the auto sector.

Sohinder Gill, Director General, Society of Manufacturers of Electric Vehicles, said that there are still many parts of electric vehicle componentry such as lithium cells, permanent magnets for electric motors, semiconductors, etc that will need to be imported and they expected rationalisation of customs duty on such essential imports to help keep the electric vehicle prices in check. Gill also said that the continuation of the customs duty-free status for machinery used to produce lithium-ion batteries could result in some stabilisation in battery pricing.