Make hay while the sun shines. The scenario is quite different for Indian motorcycle manufacturers though, it is the monsoon that brings a positive change in their sales charts. A good spread of monsoon across the country brings about a positive sentiment among customers, which is eventually reflected on the manufacturer’s sales charts. Here is BikeWale’s list of the top motorcycles who took full advantage of the healthy monsoon and the ones who failed to make the most of it.

Winners

Honda CBR150R

It would be fair to say that the Honda CBR150R’s performance in the Indian market has always been quite disappointing, with numbers touching as low as 13 units in May 2016. Now though, Honda’s entry-level sportbike has sprung quite a surprise by topping this list. Honda sold 460 units of the CBR150R in July 2016 as compared to 291 units in June 2016, translating into a growth of 58 per cent. Agreed, an increase of 169 units doesn’t sound monumental. But as far as the percentage goes, the Honda CBR 150R is the fastest growing motorcycle in the Indian market.

Royal Enfield Bullet 500

Considering the pace at which Royal Enfield has been growing since the last couple of years, it would seem sketchy if any of its motorcycles don’t end up in a list as industry’s winners. Making the company’s presence felt in this list is the Bullet 500, Royal Enfield’s most affordable 500cc motorcycle. Sales of this classic heavyweight rose from 681 units in June to 1,056 units in July, equating into a growth of 55 per cent. Now the sudden increase in demand can be attributed to Royal Enfield’s newest offering – the Himalayan. As both these motorcycles are priced quite close, sources inform us that many customers tend to opt for the Bullet 500 instead of the Himalayan, mostly because of the shorter waiting period for the former.

Hero Ignitor

Just when we thought that the diminishing sales of the Hero Ignitor might end its spell in India, the 125cc semi-faired bike surprised us by securing the third spot on this list. Sales grew from 1,217 units in June 2016 to 1,695 units in July. This 39 per cent growth can be attributed to recent updates including new paint schemes and decals which have breathed a new lease of life in the motorcycle.

Losers

Honda CB Hornet 160R

After getting off to an impressive start, sales of the Honda CB Hornet 160R have suddenly started declining in the Indian market. Honda sold just 2,660 units in July 2016 as opposed to 7,038 units in June, despite offering special discounts on the model. However this 62 per cent drop reflects only the scenario in the Indian two-wheeler market. Off late, Honda has increased the exports of the CB Hornet 160R which has also resulted in a brief waiting period for the motorcycle in select cities. The CB Hornet 160R is HMSI’s top selling export model after the Dio, and has been in demand in countries like Sri Lanka. As such, this drop in sales doesn’t necessarily mean that the popularity is waning. We can expect the CB Hornet 160R to spring a surprise anytime soon and move to the other end of the growth scale.

Yamaha Saluto

Having established its roots in the more enthusiast-oriented 150cc segment with the FZ-S and the YZF-R15, Yamaha launched the Saluto with an eye on the lucrative 125cc commuter segment. And while the sales numbers have always been quite steady, July turned out to be one of the disappointing months for the Saluto. Sales dipped from 7,955 units in June 2016 to 3,955 units in July, a drop of 49 per cent.

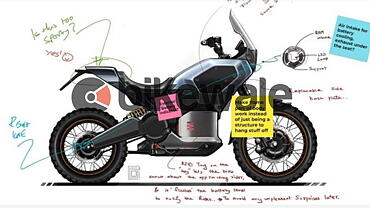

Royal Enfield Himalayan

Considering its offbeat character, it was quite obvious that the Himalayan was never going to attract the kind of audience that the other Royal Enfield models usually do. Despite this, sales of this part adventure part touring motorcycle had been on a steady rise. At least until Royal Enfield announced a recall. Sales have now plunged from 1,357 units in June 2016 to 828 units in July, a drop of 39 per cent. Apart from doubts about the reliability about the motorcycle, the long waiting period also has had an effect on customers’ buying decision.